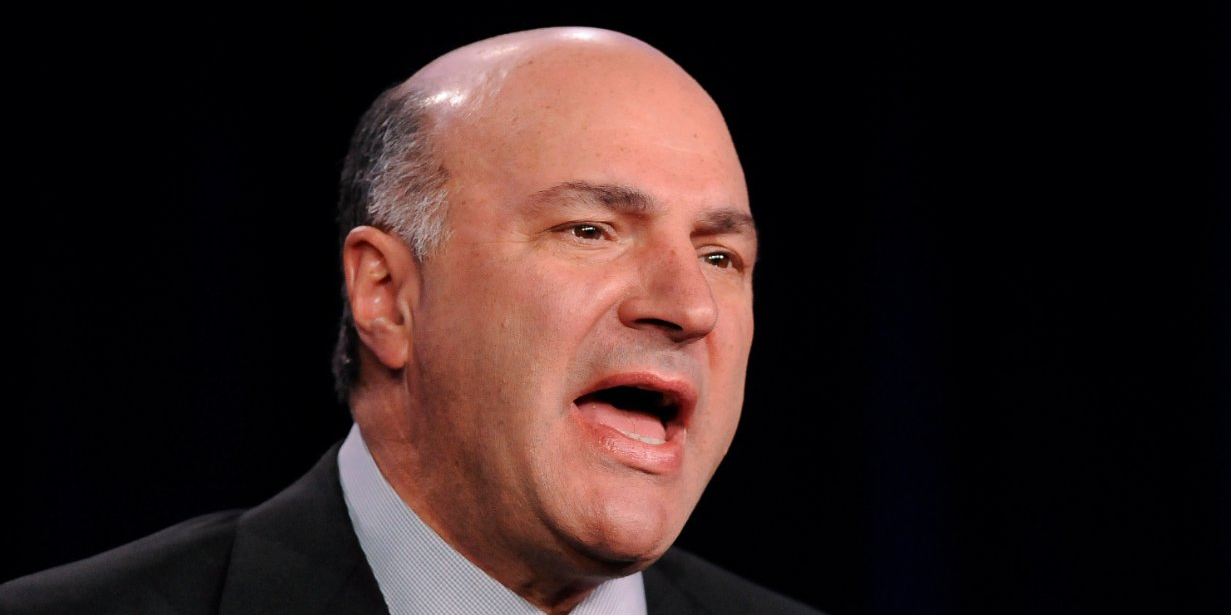

REUTERS/ Gus Ruelas

- Kevin O'Leary touted GameStop, Robinhood, and NFTs in an interview this week.

- The "Shark Tank" investor warned about airlines, leverage, and celebrity SPACs.

- O'Leary also blasted prospective tax hikes and took aim at China.

- See more stories on Insider's business page.

"Shark Tank" investor Kevin O'Leary suggested GameStop could execute a Netflix-style comeback, predicted several US airlines will go bankrupt over the next two years, and warned of a brutal market correction in an interview this week.

The O'Leary Funds and O'Leary Ventures boss – whose nickname is Mr. Wonderful – also slammed celebrity SPACs, praised Robinhood, and trumpeted NFTs during the conversation with influencer Kevin Paffrath on his YouTube channel, Meet Kevin.

O'Leary also criticized the Biden administration's plan to hike corporate taxes, and called for the US to take a tougher stance towards China.

Here are O'Leary's best quotes from the interview, lightly edited and condensed for clarity:

1. "I'm waiting. So far there's been no correction, but I've lived through lots of volatility and I know, just when it seems to be safe, poo poo happens." – discussing the prospect of a market crash.

2. "GameStop's brand has way more value today than it had five months ago, before it became part of every headline around the world, day after day. Netflix saw the writing on the wall when they were mailing DVDs to everybody and said, 'We're going to digitize this,' and they had a brand. Maybe GameStop can do the same thing."

3. "If I was short GameStop stock right now, I'd be worried. I think it's going to get a second kick at life. This whole social constituency supporting it - the pricing of the stock is kind of irrelevant at this point."

4. "It's hilarious if you look at the volatility of Amazon over the last 20 years. You would have never owned it as it's so volatile, but in the long run it's created a trillion dollars' worth of value for shareholders. Same thing is going to happen to these stocks that are going to provide digitization." - underscoring the growth prospects of Zoom, Shopify, and other stocks that enable remote activities.

5. "It's not good news for the airlines because even though they're coming back, it's all basically vacation tickets. Everybody's going to Disneyland in a big tube. That's a very crappy business, they won't make any money. Over the next two years, probably a couple of them have to go bankrupt." - underscoring the challenges for airlines if business travel permanently falls by 15% or 20%.

6. "Frankly I'm not a big fan of SPACs. I do have about 20 SPACs in my portfolio right now, but only from operators that I know. A SPAC is no different than private equity, and so I need to know the team that's backing the SPAC has done deals before, knows how to buy at the right multiple, and knows how to operate. I'm against the idea that some celebrity knows what they're doing in private equity, it's a joke. I avoid those like the plague, I think those are going to go to zero."

7. "I'm a big fan of Robinhood because even though it's got a lot of criticism, it helps 22 million people learn about stocks. I'm a big believer in learning the ways of the stock market."

8. "When you get into these complex straddles and collars and all of this stuff with leverage, sometimes you wake up with a hangover after going out to a party, and you forget the position you have on and you just blow yourself up. You've got to be careful."

9. "I'm beyond sanctions, I want to take them right out of the financial system in North America." - calling for the US to adopt a tougher stance towards China in order to level the playing field.

10. "Elon Musk is a maverick who doesn't play by the rules, but he's actually a good example of how this relationship should work. If American companies want to go to China, they shouldn't have to give up control of their intellectual property to do that."

11. "If you believe that burning up huge amounts of coal is detrimental and I do, you should stop buying bitcoin from the Chinese. Over time, as institutions start to really get involved in crypto, you'll have the discounted blood coin from China and you'll have the premium virgin coin with provenance - no different than blood diamonds."

12. "NFTs are a derivative of the digital economy. There's merit, but as a new asset class it's going to be immensely volatile. The idea that you have something that's copyrighted in perpetuity and can't be forged is really interesting and a good idea. At the end of the day they will find their place."

13. "You're pouring free money out of the sky from a helicopter into anywhere you can stuff it. But then you're raising taxes so you're taking it back right away, before it has a chance to have any effect whatsoever. You can't suck and blow at the same time, it doesn't make any sense." - criticizing the Biden administration's plan to follow up its stimulus efforts by raising corporate taxes.

14. "The idea that Yellen can run around the world asking for a standard minimum corporate tax is a joke that's never going to happen."

15. "I covet downside protection much more than outperformance. I don't care about beating the indexes at all. I don't need more money, I need to keep what I've got."

16. "Buying the dip is more rock and roll, but what invariably happens is you go through a massive correction and you learn a very important lesson. The generation that is trading right now has never gone through a sustained correction. It's coming - I don't know when, I don't know what'll trigger it, but they will learn their lesson. If you have a lot of leverage on, it's a hell of a lesson because you end up in a negative net-worth position. But you do learn from it."

17. "Take 10% of your paycheck, put it away, and do not touch it except in emergencies. When you take money and burn it on a vacation, or buy some useless piece of crap you're never going to use - which many people are guilty of including me - you've killed off your future. That money's not working for you anymore. Do you really need another pair of jeans, another pair of shoes? Just look at your closet of all the crap you don't wear, that's all money you wasted."

18. "If you walk around with an Apple Watch on, that thing is a piece of consumer-electronic junk. I own Apple stock, but I would never be seen dead with an Apple Watch. Not a chance in hell." - voicing his preference for wearing traditional watches and supporting conventional watchmakers.